Additional Personal Finance Software #11) BankTree. BankTree is a personal finance software that can be used on desktop, web, and mobile. It provides easy to use money management features. You can try the tool for free. Its price starts at $40. It has the capabilities of accounts, investments, and reports. It will let you track your investments. MacUpdate's software library contains more than 153 Personal Finance apps designed for Mac owners. Choose the best app and download it today for free. Realted: Best Finance Apps for Every Budget. TurboTax is a bit different than the other software on this list, in that it doesn’t get involved in budgeting or investing. No list of personal finance and budgeting apps is complete without mention of Quicken, and with good reason. This app almost predates the computer age—it has been around in one version or another since 1983. That said, it is a bit old-fashioned in some ways. MacUpdate's software library contains more than 144 Personal Finance Software apps designed for Mac owners. Choose the best app and download it today for free.

It is probable that you are not very familiar with Mac and apps that are available for it. If this is the case, in the present article, we are going to describe some of the best apps for Mac and how they work. The Macintosh (well knows as Mac) is a family of personal computers that was designed by Apple Inc. There are many apps for this family of personal computers, but we are going to talk about the 8 best finance apps for Mac and what their features app. You as user will choose the best option for you.

First and foremost, I think it is very important to know what Mac is and how it works in order to understand the present article in the best way possible. Well, we can define Macintosh as an important family of personal computers that have been developed and manufactured by Apple Inc. since early 1984. The original version was the Apple´s first mass-market personal computer that included a graphical user interface and mouse. The company sold this family of computers for ten years before the last version was cancelled.

The first Macintosh models were expensive, many people can’t buy it and this was great because it mean this brand was very luxury and sophisticated. During the nineties, Apple launched new models like the Macintosh LC II and Color Classic. In the current article, I am going to describe some of the best finance apps for Mac. It is not possible for me to mention just one because there are many.

The best finance apps for Mac

iBank 5

The iBank app is one of the best finance apps for Mac due to its enormous wide range of features. For instance, you are allowed to download transactions from your banks and also import transactions from online banking sites. Apart from this, it also offers the envelope budgeting option and support for your investments, multiple currencies, and so on.

Furthermore, it also added support for investments, and other awesome features that are completely available for Apple devices such as the IPhone, IPad, among others. If you are interest in managing all aspects of your personal finances in the most effective way possible, the iBank 5 app is one of the best choices for you and your personal needs. Your finances are so important for you and your family.

MoneyWell

This amazing finance app is very similar to buckets displayed with the dollar amount available. In addition, MoneyWellis distributed among the buckets taking into consideration bill due dates and priorities. This service record expenses and empties the buckets at the same time. If you tipped a bucket over, you spent more money than you previously allocated for that expense.

Quicken 2015 for Mac

The Quicken 2015 for Mac app is a very good choice, instead of using Quicken Essentials. It also allows you to add investments and income tax support, among other features. It is available for Mac and IOS, so it is a good option for Mac users.

Liquid Ledger

This incredible finance app provides you with many personal finance features such as the built-in calculator, multiple currency support and the possibility to print checks. These awesome tools are real time savers.

SplashMoney for Mac

At the beginning, this program was a Palm PDA application, and then it was added support for desktop computers, which was fine for many users. With the use of the SplashMoney for Mac app, you are allowed to get it for your Mac desktop, Pocket PC, or your smartphone. Apart from this, it offers you secure blowfish encryption.

You need A Budget

The You Need a Budget app is capable of running on a Mac thanks to Adobe AIR, which is a platform that lets the app´s slick look with simple to read graphic qualities. If you are interested in keeping tabs on their personal budgets, this is the best choice possible for you. Apart from this, it also offers interesting options for learning about budgeting.

Fortora Fresh Finance

This awesome app provides you with many features such as the possibility to share personal finance data among several users on your desktop computer or over a network. Thisdata works with the Mac and also Windows versions of this personal finance app. Each copy of this app can be used on more than 3 computers.

MoneyDance

This personal finance app provides you with a wide range of features such as support for multiple currencies, decent financial reports, data, and so on. The only bad thing is that it has to be easier to use and offers another kind of interface for users.

Everybody of us is acceptable at a couple of things, yet none of us are acceptable at everything. This is the reason Personal finance software for Mac has gotten so mainstream lately.

You might be an amazing architect, medical caretaker, or educator. Yet, you may not be so sure about your abilities with regards to planning, escaping obligation, setting aside cash, or contributing.

Personal finance software for Mac can help you in every one of these territories, and that is the reason they are quickly getting so well known.

Once in a while, all you need is the presentation of formal structure, and you’ll have the option to oversee territories of your accounts you haven’t been effective in controlling before.

Shockingly, the individual fund is certifiably not a subject that is instructed in secondary school or school. You need to learn it as you move into grown-up life. What’s more, a few of us do require some assistance here.

You should simply figure out what your most prominent personal finance software need is, and coordinate it with the best close to home money programming for that class. On the off chance that you can, at that point, you may have discovered the ideal programming for you.

Making and living inside a spending limit is perhaps the most ideal approach to keep away from chapter 11. It’s likewise pretty much the ideal approach to start setting aside and putting away cash.

All things considered, until you can make additional room in your spending limit, you won’t have any money to spare and contribute.

Top 9 Personal Finance Software For Mac in 2021

Here the Personal Finance Software For Mac in 2021.

1. Personal Capital

Personal Capital is accessible for both Windows and Mac. Also, it’s one of the absolute best close to home money programming at any point made. This is on the grounds that Personal Capital exceeds expectations in both planning and contributing.

Planning programming is accessible through their Free Personal Software. You can mix it up of various records to the stage, including ventures, credits, and financial balances.

It offers speculation following, a retirement organizer, a 401(k) charge analyzer, and a venture registration device that screens the wellbeing of your venture distribution.

However, in the event that you choose you to need progressively explicit venture administrations, for example, direct speculation the board, that is accessible through Personal Capital Wealth Management. It gives full administration administrations of your interests in different records.

Also Read: Best Audio to Text Converter Tools

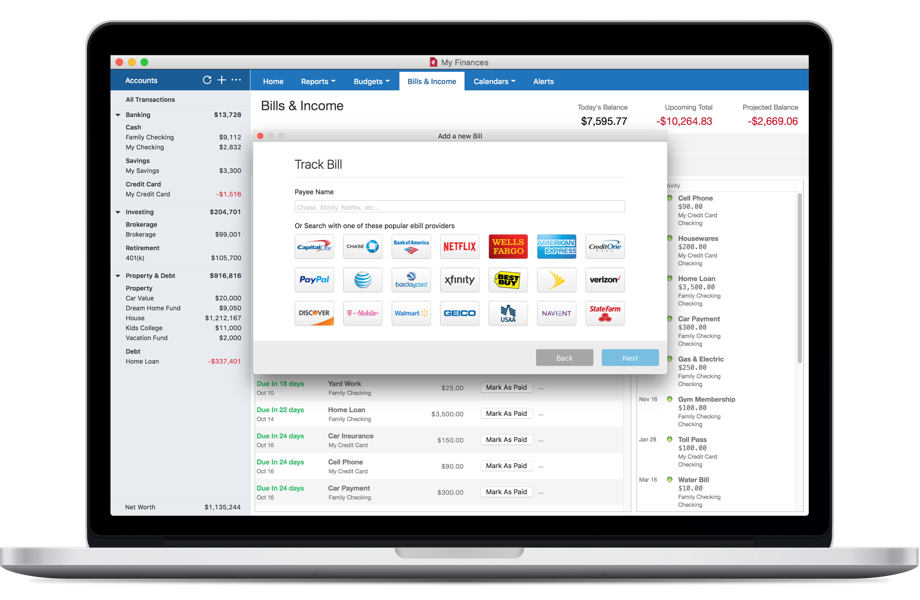

2. Quicken Premier

Quicken Premier offers both planning and contributing, yet it has a solid accentuation for contributing. It charges a level yearly expense of $67.49, and it packs a ton of venture benefits at that expense.

Animate Premier gives an incredible line up of speculation apparatuses including:

- Educated purchase/sell choices

- Hidden additions

- Ceaseless statements

- Printable and exportable portfolios

- Speculation execution shows

On the planning side, Quicken Premier empowers you to see adjusts, spending plans, records and exchanges, track spending patterns, and search your exchange history. You can likewise change your information over your work area, web, and cell phones.

3. Mvelopes

Mvelopes is principally a planning programming. It empowers you to boundless interface records, and gives constant planning, with programmed exchange adjusting so you’ll keep awake to date on your spending movement.

However, the stand apart component of this product is that you gain admittance to monetary training.

At regular intervals, you’ll get a meeting with an individual fund coach, who will give direction and authorized criticism on your advancement. This will furnish you with live help, which might be the inspiration you need.

Mvelopes offers three distinct plans:

- Essential – $6 every month

- Also – $19 every month.

- Complete – $59 every month

For the vast majority, the Basic assistance will be adequate. It gives large envelopes and money related establishment accounts, programmed exchange bringing in and account balance checking, live talk and information base, and intuitive reports.

Be that as it may, if you need assistance explicitly with obligation issues, you can pursue the Plus arrangement, which has explicit obligation decrease highlights.

On the off chance that you need to expand direct close to home help, the Complete arrangement offers a committed individual mentor, just as a customized budgetary arrangement. Training meetings are accessible on a month to month premise.

4. YNAB

YNAB is one of the most well-known personal finance software for Mac accessible and in light of current circumstances. They give you a necessary four-stage procedure to deal with your cash:

- Give Every Dollar a Job: Here, you choose what each dollar in your spending will do among now and your next check.

- Grasp Your True Expenses: This progression urges you to get ready for enormous future costs that way you’re prepared before they show up, and they won’t agitate your financial limit.

- Move With the Punches: This progression causes you to get ready for the unforeseen. In the event that one spending thing will be high, you just move assets from different envelopes into that one. It empowers you to manage a more upper-cost class, without upsetting your general spending plan.

- Age Your Money: This is one of the highlights that makes YNAB extraordinary in the planning programming world. This progression moves you towards going through cash today that you earned a month ago. That is, it empowers you to put your salary/financial records one month in front of your costs.

YNAB charges $6.99 every month for the administration, however not before you get a 34-day free preliminary. The organization guarantees new budgeters spare $600 regularly month, and more than $6,000 the first year by utilizing the administration.

5. Banktivity

What makes Banktivity stand apart is that its monetary programming structured explicitly for Mac. The organization claims clients can spare $500 every year and around 40 hours by utilizing the application.

Banktivity works by associating all your budgetary records with the application. You can interface with more than 14,000 diverse monetary organizations, and the administration even empowers you to follow the estimation of your home.

When you match up all the records you have, you can make spending utilizing an advanced envelope planning framework. It will distribute every dollar in your check toward explicit spending classes.

It incorporates paying costs, yet it additionally causes you to finance explicit objectives. For instance, you can set up goals to set aside cash for the upfront instalment on the house, to take care of obligation, or to buy another vehicle.

Banktivity’s fresher variant is $69.99, and the more established rendition is $64.99. Banktivity accompanies a 30-day free preliminary. The administration likewise accompanies a 90-day unconditional promise, as long as you buy the product on the web.

6. TurboTax

TurboTax is somewhat not the same as the other programming on this rundown, in that it doesn’t engage in planning or contributing.

In any case, it focuses on one essential part of an individual account, and that is the readiness of your annual government form. Also, that is the thing that TurboTax shows improvement over some other programming accessible.

TurboTax is accessible for the two Windows and Mac, and it’s assistance well worth having. In addition to the fact that it costs a small amount of what you will pay an expert expense preparer, similar to a CPA.

Yet, it additionally gives you access to either a CPA or an enlisted operator, on the off chance that you arrive at a point in the arrangement procedure where you’re experiencing issues.

TurboTax even gives you the choice to buy it’s Audit Defense Package to help you on the off chance that you’re evaluated.

However, should you choose – part of the way through the arrangement procedure – that you can’t finish your arrival, you can surrender it to a CPA or selected operator, who will finish the entry by remotely getting to your PC.

Also Check: Best Remote Desktop Software to Use

7. Moneyspire

Easy and powerful budgeting and personal finance software for Mac that helps you manage your accounts, bills, budget, and more. Moneyspire is close to home fund programming and private venture bookkeeping programming created by Moneyspire Inc.

The product is accessible in two renditions, one for Windows and another for macOS. The product tracks accounts, credits, bills, speculations, and spending plans. Proficient looking solicitations can likewise be made and followed in the Pro version of Moneyspire.

Best Free Personal Finance App For Macbook

It imports information from QIF, OFX, QFX, and CSV files. Moneyspire can utilize its budgetary information documents conversely between the Mac and Windows renditions of the product along these lines settling on the product a feasible decision for individuals who use the two PCs and Macs.

Moneyspire can likewise oversee accounts from different monetary standards, and consequently, track trade rates and moves between remote records.

Moneyspire also permits downloading of exchanges straightforwardly from budgetary organizations through the Moneyspire Connect administration.

8. Pocketsmith

Brilliant planning and individual fund programming. Deal with your financial limit and figure your accounts with PocketSmith, the best close to home money programming on the web.

Deal with your cash. See all your bank, Visa and advance records in a single spot. Live Bank Feeds keep PocketSmith consequently refreshed, so you can see where your cash is going. This application requires a PocketSmith account.

9. BUFFER

Online cash the executives programming for individual money, account accumulation, planning, charge updates, and anticipating. Likewise helpful for parting rent, staple, café bills, and IOUs with companions and flatmates.

Buxfer is one such program based program that makes it simple to transfer your ledgers, set up a financial limit, and track your pay and costs.

Its interface is spotless, straightforward, and natural, so you can undoubtedly finish your home bookkeeping undertakings, which is the reason to prescribe Buxfer for individual account programming.

Buxfer gives the entirety of the network choices we searched for in-home money programming. You can synchronize straightforwardly to your budgetary organizations, including charge cards, checking, reserve funds, money, credit, and speculation accounts. You can likewise connect to your PayPal account.

At the point when you match up your records, the entirety of your equalizations and exchanges update in the framework and are naturally sorted.

You can likewise alter any data transferred by changing the thing name, label name, classification, and catchphrases it ought to join too.

Eleggible’s Final Words

Some portion of what confuses the quest for the best close to home money programming is that there are currently such vast numbers of plans accessible. You could go through weeks or months looking through the many potential decisions that are out there.

Best Personal Finance App Iphone

It might help to initially choose precisely what you anticipate that the product should accomplish for you so that you can limit the pursuit.

Personal Finance Apps For Windows

What this indeed implies is that there’s nobody size-fits-all with regards to personal money programming. Select the one that works best for you, in light of where your money related circumstance is at the present time. You can generally roll out an improvement later, as your conditions and budgetary needs change.